In responding to complaints that their economic citizenship programs allow high-risk individuals to obtain passports from a low-risk jurisdictions, proponents often point to the quality of due diligence that outside companies conduct on the applicants, especially in the five countries of the East Caribbean known for their CIP programs. A Civil Penalty recently levied by the Office of Foreign Assets Control (OFAC) could be a sign that these firms, and their actions, may not be as effective as we believe.

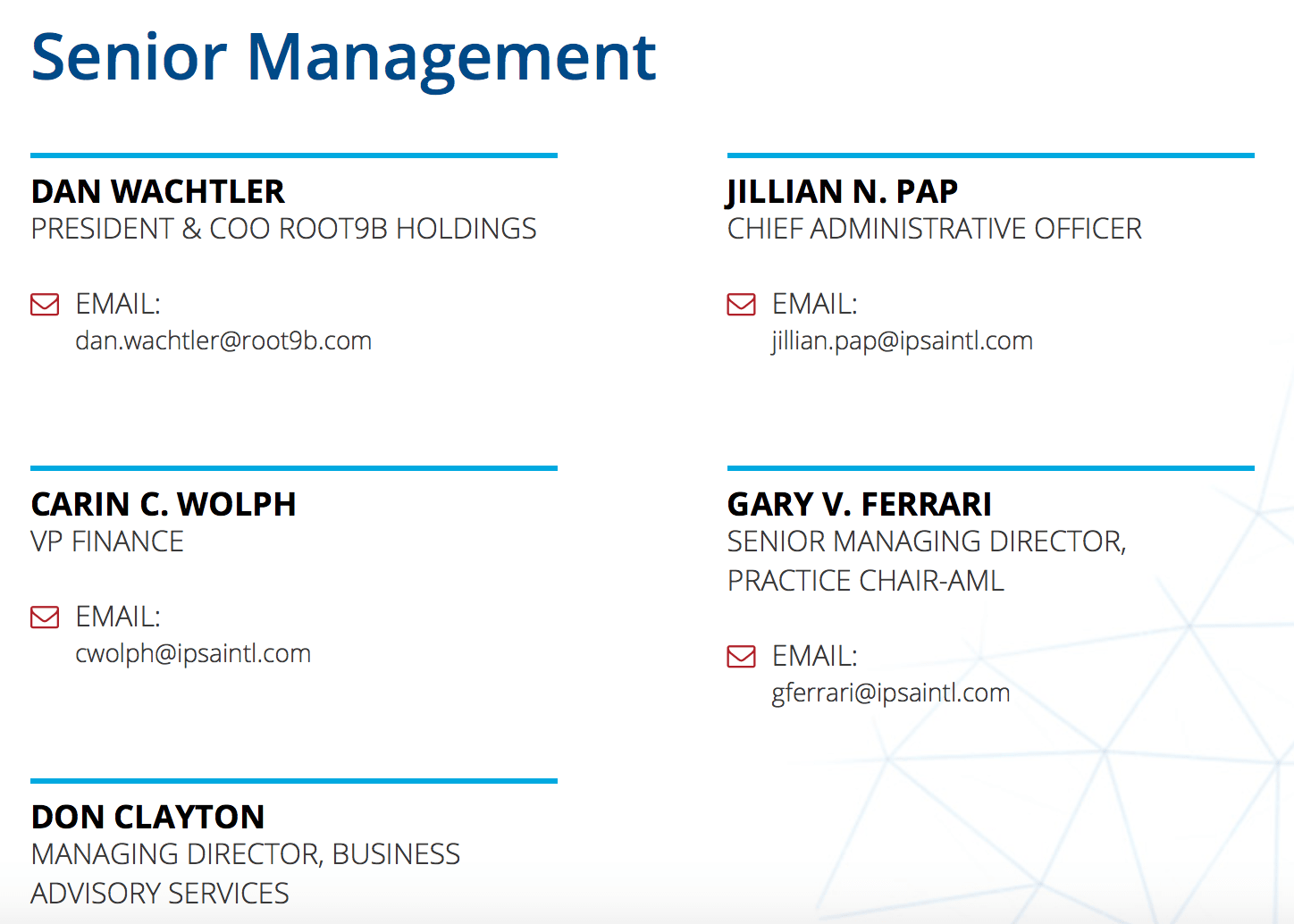

IPSA International Services Inc., a US-based "global business investigative and regulatory risk mitigation firm," has agreed to pay $259,200, to settle what OFAC describes as apparent violations of Iran sanctions regulations. The transactions cited totalled $290,784.

IPSA, which conducted due diligence investigations for an unnamed country's (St Kitts?) Citizenship by Investment program, when faced with vetting Iranian nationals, engaged its Dubai subsidiary to perform the tasks. That subsidiary in turn hired local background investigation contractors, working inside Iran, to obtain the information, and forward it to the US parent company, which used it in its due diligence investigations. The Iran-based contractors were thereafter paid by the Dubai subsidiary.

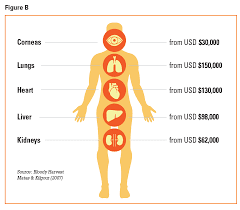

OFAC found that IPSAs compliance program was ineffective, with respect to the risks of the company doing business with Iran-origin background investigation services. If we cannot trust due diligence providers to obey US laws, how can we trust that they are delivering accurate and complete information to the operators of CBI programs ? The Civil Penalty also confirms that a large number of Iranian nationals are seeking to acquire citizenship, and passports, from low-risk countries located far from conflict zones. Since the Iran-based background investigators are in a jurisdiction where they cannot be disciplined, for negligence, or even intentional misinformation, how can we be sure that their data is truthful, current, and accurate ?

Furthermore, the consensus of opinion among North American compliance officers is that Caribbean CBI country operators are often disregarding the accurate due diligence investigation reports they request, and approving dodgy applicants purely for corrupt monetary reasons, in Dominica and elsewhere, leading us to question the compliance comfort level of all East Caribbean CIP passports, from a risk-based perspective. The IPSA case should be a wake-up call to treat all passports from these jurisdictions, where the passport shows the holder was born in another country. with special attention.

Chronicles of Monte Friesner - Financial Crime Analyst

Contributed by Kenneth Rijock - Financial Crime Consultant