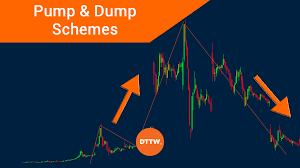

Inasmuch as we will be diagramming what are commonly known as "Pump and Dump" fraudulent stock sales schemes in our upcoming articles about Iranian fraudsters operating from Canada, and targeting American and Canadian investors, we believe that a concise analysis of how schemes work is relevant.

Pump and Dump, also sometimes known as an "Oklahoma" scheme, is a fraudulent method through which financial criminals manipulate the apparent value, and thereby price, of marketable securities. The scheme is accomplished through a variety of methods, all of which is designed to convince a ready, willing and able purchaser to buy the fraudster's stock.

(1) The most commonly-used technique is to orchestrate captive sales, between confederates or co-conspirators, at prices higher than the actual market value. This may be repeated, until the published sales prices are substantially increased. At that elevated price, the fraudster intends to sell the artificially-inflated stock to an unsuspecting public. He is often successful.

(2) To motivate innocent sellers into purchasing the now extremely-overvalued stock, the fraudsters resort to a number of media methods: paying commentators an illicit fee to spread false or misleading information about the stock's value, use of Internet chat rooms, social media sites, investment research sites, and even newsletters. All these are designed to attract the victims to the specific securities that the fraudsters have already inflated, by hyping the attractiveness of the stock to buyers.

(3) Another method is to spread false information about a positive event at the company that will imminently increase the worth and value of the stock, such as the release of a new product, merger with another entity that will result in the sale or exchange of shares at an increased price, approval of a regulated product by a government entity, news about a patent, or other favorable news. Of course, the information is a fabrication; there is no factual basis for the "inside" information being promoted.

(4) The stock, after its purchase, rapidly loses value in the marketplace.

These methods, often used in tandem, have been employed by our Canada-based fraudsters, to trick and deceive American and Canadian investors into purchasing securities at inflated rates. Often, these stocks are of extremely low value, verging on worthless.

Contributed by Kenneth Rijock - Financial Crime Consultant (USA)

Chronicles of Monte Friesner - Financial Crime Analyst (Canada)